ADVERTISEMENT

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300.

Program begins February 9.

THE BRIEF

Hey all, it’s MMV.

A big part of why I wanted to offer MMV Pro is to expose my audience to relatable business building.

I believe that by sharing deep details of how businesses were built in a structure that makes it easy-to-digest and is actionable to readers, it’ll motivate my audience to try it for themselves. These case studies will be broken down to make you think “that’s not so hard”. Today’s case study is about an influencer you’ve probably seen on either LinkedIn or X.

Justin Welsh is a “creator influencer”, known for his big LinkedIn and X following, and built his business primarily through those two channels as a solopreneur.

A key message he frequently shares to his audience is that he built his business for freedom, not just for money.

He scaled his audience-driven business with zero full-time employees and that’s why he considers himself a solopreneur.

Continue reading (full access for MMV Pro Members only) to learn how he actually built it in the early stages and how you can apply the same strategies to your wealth trajectory.

RECENT NEWS

📈💰🌎 Business & Economy News

🏦 Treasury cancels Booz Allen contracts after employee leaked Trump tax records; stock falls

Booz Allen Hamilton’s stock price dropped by more than 10% from the news. Basically, they lost $21M of contracts which is a drop in the bucket, but maybe other agencies will follow.

🏅 Gold tops $5,000, silver soars as 'breathtaking and profoundly scary' rally continues

Amazing rally.. experts say markets are increasingly fearful that governments will attempt to inflate away out-of-control debt.

🇰🇷 Trump says he is raising tariffs on South Korean imports after trade deal delays

Trump says tariffs will rise to 25% from 15% due to “delays” on South Korea’s legislation, but South Korea's National Assembly isn’t in regular session and the next bill review sessions are due to start on February 3. Overreaction much?

ADVERTISEMENT

Dalio: “Stocks Only Look Strong in Dollar Terms.” Here’s a Globally Priced Alternative for Diversification.

Ray Dalio recently reported that much of the S&P 500’s 2025 gains came not from real growth, but from the dollar quietly losing value. Reportedly down 10% last year!

He’s not alone. Several BlackRock, Fidelity, and Bloomberg analysts say to expect further dollar decline in 2026.

So, even when your U.S. assets look “up,” your purchasing power may actually be down.

Which is why many investors are adding globally priced, scarce assets to their portfolios—like art.

Art is traded on a global stage, making it largely resistant to currency swings.

Now, Masterworks is opening access to invest in artworks featuring legends like Banksy, Basquiat, and Picasso as a low-correlation asset class with attractive appreciation historically (1995-2025).*

Masterworks’ 26 sales have yielded annualized net returns like 14.6%, 17.6%, and 17.8%.

They handle the sourcing, storage, and sale. You just click to invest.

Special offer for my subscribers:

*Based on Masterworks data. Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

THE BRIEF

🛠️ From Corporate to Solopreneur (Before the Internet Knew Him)

Before Justin Welsh became the influencer he is, he was a SaaS sales executive. He sent over a decade in sales, growth, and executive positions in enterprise software companies.

His last position was Senior Vice President of a fast-growing startup called PatientPop. In the last four year of his time at PatientPop, he grew the business from zero revenue to over $50M in ARR. As SVP, he oversaw a team of 150 people before hitting burnout in late 2018.

The Breaking Point

In December 2018, Justin experienced his first panic attack. Running a massive team caused a lot of stress so he coped by eating and drinking too much. He wasn’t sleeping well and became 40 pounds overweight.

That panic attack became the moment he realized it was time for a change.

Looking back, it was a learning lesson that success by corporate standards wasn’t success for his life.

While most people who burn out don’t find a new path (they just switch jobs), Justin reimagined his entire career.

He told his CEO that he wanted to step down. The CEO asked him to stick around until August, and he agreed.

While he started taking care of himself by eating better and losing a ton of weight, he thought he’d build a consulting business and get it ready by the time he stepped down.

That’s when he started writing about his journey building PatientPop on LinkedIn.

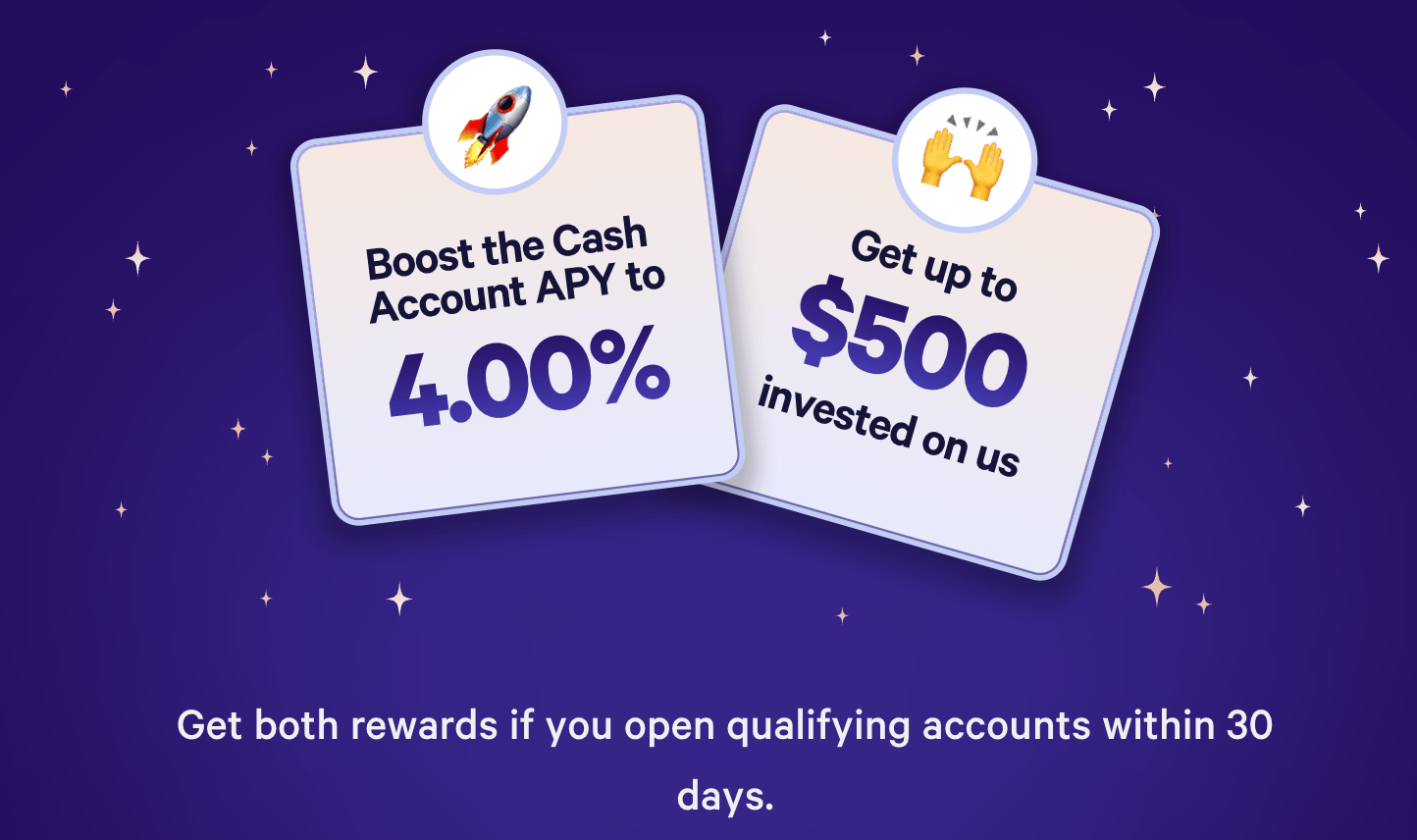

APP RECOMMENDATION

My Favorite High Yield Savings Account

THE BRIEF CONTINUED

🛜 Building an Audience and Finding Customers

Here’s something many people don’t know:

Justin started posting content before he left his job.

The Social Experiment

He believed “attention is the new currency” and wanted to test his hypothesis before taking the leap.

In early 2019 he began sharing practical sales and leadership lessons on LinkedIn.

Within ~6 months he grew from 0 to 20,000 followers on LinkedIn. How? He was helpful and consistent at a time most executives weren’t publishing on LinkedIn at all.

What made Justin’s content stick out back then was that no one else was doing this. LinkedIn wasn’t the platform it is now where people share advice or try to be a thought-leader.

That audience became his potential customers.

When Justin finally quit his corporate job on August 1, 2019, he didn’t start with courses like he sells now. He started with consulting.

First Money As A Solopreneur

He paid a web design company to build him a website on SquareSpace and launched his consulting business. He closed $40K in customers on the very first day!

As his audience grew, he noticed something strange. His private messages weren’t about sales and marketing, but how he writes content and how he was growing his following.

People weren’t paying for SaaS strategy anymore. They were asking:

How did he grow his LinkedIn?

How to create regular content that leads to business?

What systems did he use?

This was REAL market research and he productized it.

Subscribe to PRO Membership to read the rest.

Become a paying subscriber of PRO Membership to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Free copy of the Personal Finance Dashboard

- Access to exclusive real-life case studies, interviews with vetted guests, and AMAs

- Access to the entire archive

- [FUTURE] Access to community forum & mini-courses