A survey done by Clever Real Estate found that a whopping 93% of recent homebuyers have regrets — up from 72% in 2022.

The reasons why include too much home maintenance, spending too much, rushing to buy, and buying a fixer upper (probably watched too much HGTV).

If you’re considering buying a house soon, you’re going to want to read this.

In this post, I’m going to share why renting is likely better than buying right now so that you’re aware of what’s at stake.

If you’re new and haven’t subscribed, you can click below to subscribe so you continue to get new releases!

You’ll also get a FREE copy of my First-Time Landlord Guide after subscribing!

You can also read my blog or check out my digital products.

The Real Estate Market Summed Up

I could bore you with the details about the housing market, but I won’t do that. I’ll share some links to give you an idea:

TL;DR: Housing market is still priced too high with already high interest rates and housing prices are falling the most in the pandemic hotspots like Austin, Boise, Phoenix, etc.

Renting vs Buying

One of the reasons why I’ve taken a step back from real estate investing is because it’s just too expensive.

I wrote about the disparity in rental rates and home prices back around May in newsletter edition #10, “Should I rent or buy where I live? That depends..”.

To view the full archive of past newsletter, you will need to upgrade to a premium member.

As my fiance and I looked to relocate to a new city that made sense for our future, we initially wanted to buy, but in most areas, it became a no-brainer to rent instead.

Renting vs Buying Example

We were looking for a house with at least 3 bedrooms in Allen, TX (Dallas Metro) like this one:

To us, this is a GREAT deal because we were paying $4,000 a month in a 1-bedroom apartment in Miami. But this price is actually a great deal given the current market as well.

Here’s a home in the same vicinity, not even a quarter mile away:

These homes are in the same neighborhood, similar square footage, and similar interior quality. It was listed on August 24th at $665,000 and the price dropped several times until it was updated to $630,000 last week.

Let’s Run The Numbers

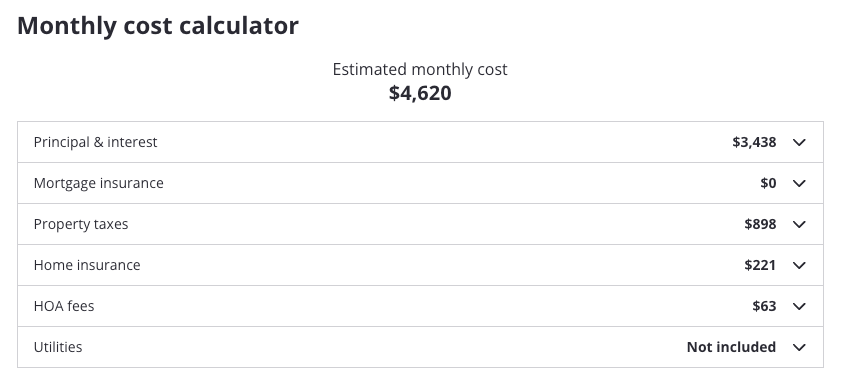

Here’s how much you would pay for the mortgage to buy this property with 20% down (or $126,000) and a 7.25% interest rate:

The difference between renting and buying this type of home in Allen, TX is $1,520 a month. This doesn’t even take into account the $126,000 down payment or the maintenance cost that comes with homeownership.

Let’s dive a little deeper..

For simplicity, let’s assume the total cost of owning ($4,620/month) and maintaining a home ($380/month) costs a total of $5,000 a month.

That’s $1,900 MORE a month than renting a similar home (and that still doesn’t even take into account the $126,000 down payment).

This market isn’t the only market I checked either. It’s like this in almost every major metro area.

In fact, according to Redfin, it’s only better to buy than rent in Detroit, Philadelphia, Cleveland, and Houston.

So here’s a total breakdown of the cost of buying vs renting in Allen, TX that can be analyze in a similar method:

The opportunity cost is the down payment being put into a high yield account like Wealthfront that offers a 5% rate (or a bonus 0.5% for 3 months when you sign up using my link).

The total “savings” between buying and renting is over $2,425 a month! That’s A LOT of money that could be used elsewhere.

While this is a very simplified approach to determining whether you should buy or not, my strong suggestion is to run the numbers instead of deciding with your emotions.

Of course there are other considerations that are personal to take into account. Buying a home isn’t all about the numbers, but it can affect your quality of life after.

I don’t want any of my readers to be part of the 93% of homeowners who regret buying their home.