If you’ve been following the news and seen what’s been going, especially on my Instagram, you probably know that I thought my last day working in the federal government was on Friday.

By some impeccable timing, CNN published an article that the mass terminations, which could affect over 50,000 civilian employees across the Pentagon, could run afoul of Title 10 section 129a of the US code. Following that report, Pentagon lawyers began reviewing the legality of the planned terminations more closely.

I’m almost positive that without that published article, I would’ve been fired last Friday.

While I’m safe today, I can still be terminated before my probation is up in less than three months.

Online Banking, Rent Collection, Accounting, & More in One Place

Simplify your real estate management with Baselane—the all-in-one platform for banking, rent collection, bookkeeping, and tenant management. I’ve been using Baselane, and I only wish I’d switched sooner! It’s made managing my real estate finances easier than ever—and the best part? It’s completely free.

Money Bulletin (News Highlights of the Week)

Musk in a social media post had warned those workers to respond to an email demanding them to submit a list of their accomplishments over the last week, or face a forced “resignation.” Agencies then pushed back and were then told it’s voluntary.

President Donald Trump said sweeping U.S. tariffs on imports from Canada and Mexico “will go forward” when a month-long delay on their implementation expires next week.

The Conference Board’s Consumer Confidence Index slipped to 98.3 for the month, down nearly 7% and below the Dow Jones forecast for 102.3. It was the largest monthly drop since August 2021.

Getting to know my coworkers opened my eyes (again)

Because I’ve been going into the office every day for work, I’ve been talking to colleagues a lot more on a personal level. We talk about life, career goals, and bits of finances (since we all know how much we each make thanks to the government’s transparent pay scale).

As government employees, we are clearly in the middle class (a broad range). I know what everyone’s salary is and I know what car everyone drives. I learned about some of their personal problems related to money and I was reminded that I’ve been surrounding myself with people who are financially savvy so learning these things about my coworkers was a bit shocking. The average American is NOT financially savvy. Probably why credit card debt surpassed $1.2 TRILLION.

Thanks for reading Spark to FIRE Newsletter! This post is public so feel free to share it.

1. Trading Time to Save Money

I have one colleague in my building who talks about wanting to retire early, but she has multiple kids so she is having trouble saving money. She complains about the commute, but she chose to live 1.5 hours away (without traffic) because the rent is cheaper by $1,000.

Because we have to be in the office daily, she leaves her house at 5AM to get parking and gets home at 6PM due to traffic. She’s easily spending 3-4 hours a day in traffic, getting less sleep, and spending more on gas.

Commuting 4 hours daily is 20 hours a week. That’s 80 hours a month spent commuting to save $1000 a month. That makes no sense to me.

I’ve tried to talk some sense to her. I’ve suggested that she can rent a townhouse (instead of a house) that’s closer to save herself half her commute time although it’s $1,000 more. Saving time and gas money will make the extra $1,000 less of a burden..

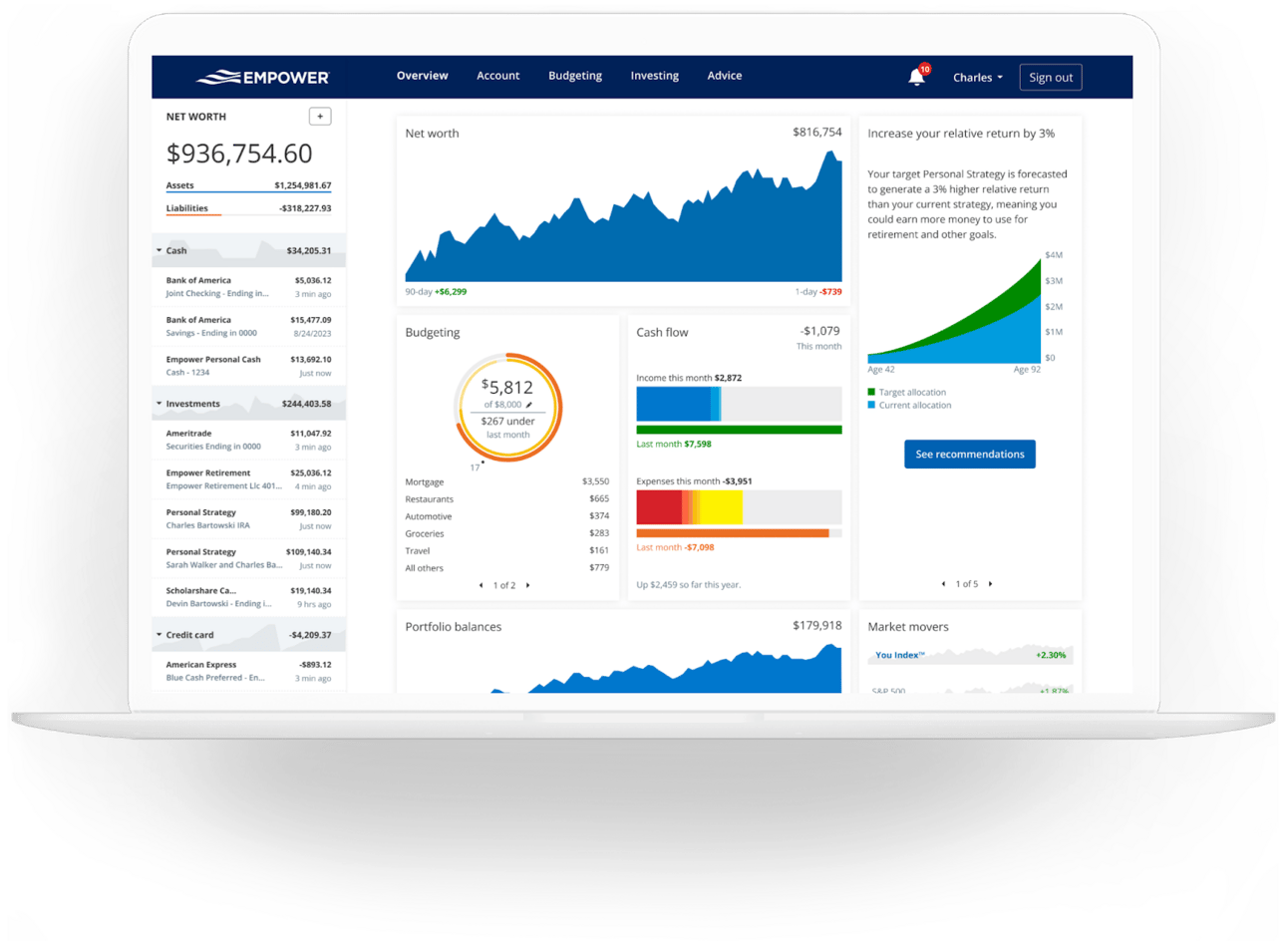

🌟 Take Control of Your Money with Empower! 🌟

Struggling to keep track of your finances? Feeling overwhelmed by budgeting, investing, or saving for the future? Empower (formerly Personal Capital) can help you master your money—effortlessly.

Here’s Why You Need Empower:

✅ All Your Accounts, One Dashboard: Connect all your bank accounts, credit cards, loans, and investments in one place.

✅ Personalized Budgeting: Stay on top of your spending and save more with the budgeting feature.

✅ Retirement Planner: Build, manage and forecast your retirement in one convenient place with your Retirement Planner.

2. Student Loan Debt is Holding Them Back

I learned that another of my other coworkers has $250,000 of student loan debt from getting two Masters degrees. I don’t know what she studied, but a Master’s degree isn’t required for our job, let alone two!

She’s currently on deferment, but that’s going to end soon. She was relying on the Public Service Loan Forgiveness program but it’ll get more difficult for her since income-driven repayments are increasing. This will put a strain on families since they will face higher monthly repayments and to qualify for loan forgiveness, borrowers are required to pay for 10 years while in public service.

With that kind of debt, I have no idea how she’ll ever get ahead.

3. 15 Years of 401(k) Contributions With Little To Show

Another coworker has been in government for 15 years. He showed me his Thrift Savings Plan (TSP) dashboard, which had a total value of $135,000 plus a $22,000 loan from their account. He had to take out a loan a few years ago and is paying himself back by about 5% in interest.

While it’s a good amount to have in retirement, it’s less than I thought it would be after 15 years of contributions. It made sense when I found out he only contributed 3% for a lot of years, 0% for some, and a good chunk was in the G fund, which is a fund of treasuries.

My strategy for retirement accounts right now is 100% stocks. I’m young-ish so no need to be risk averse.

Final Words

I’m reminded how fortunate we are to be a part of this community and to want to learn to be financially savvy.

Making a few strategic moves is all it takes to get ahead (and to stay ahead).