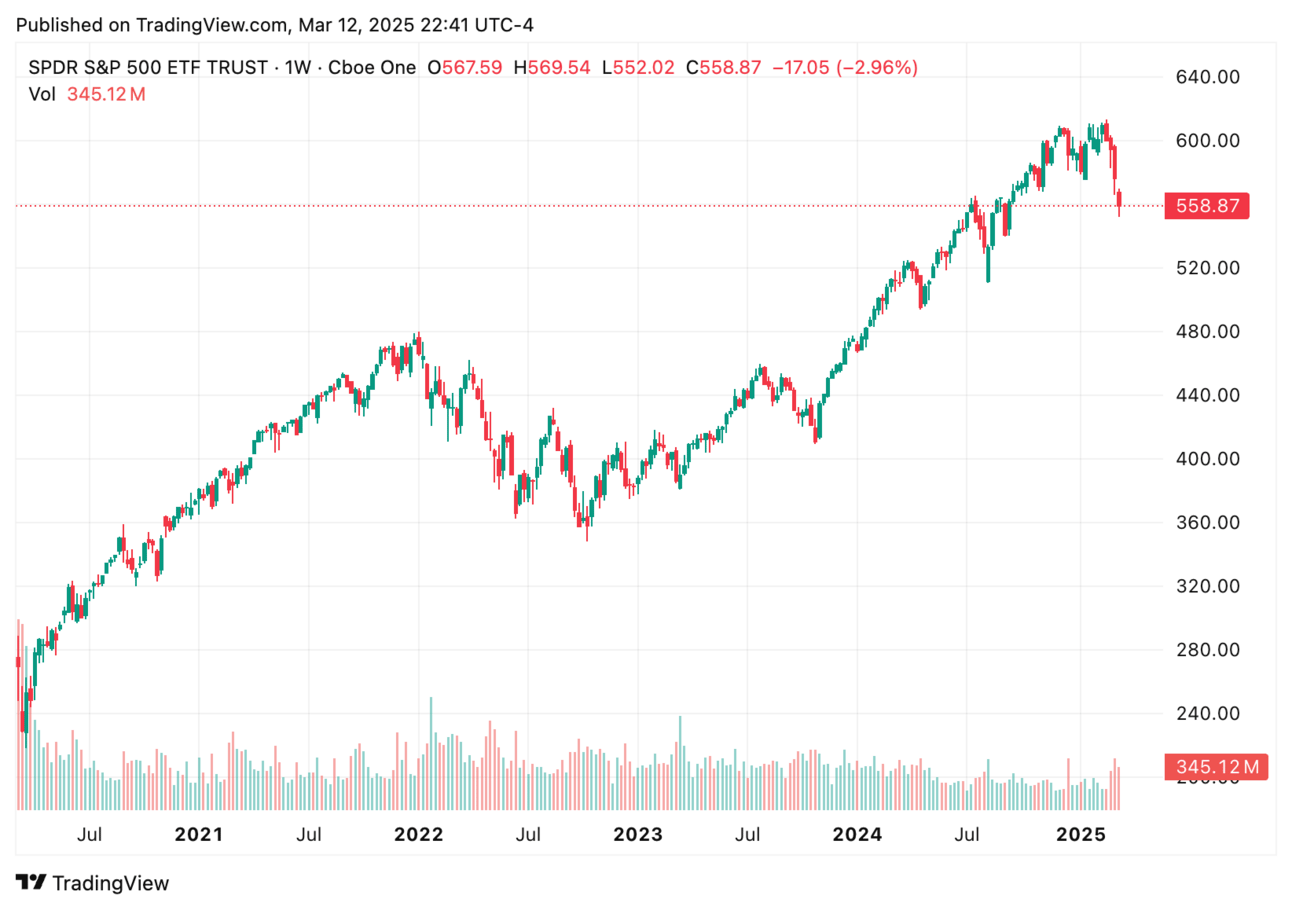

The stock market is down nearly 9% from its all-time-high back in February 19.

The problem?

Fears of a recession due to tariffs, a possible bubble burst leading to a recession, and negative business outlooks.

With so much uncertainty in the future and fears of an economic downturn, it’s no wonder that 27.4% expect a worse financial situation in a year from now.

What’s ironic is that if the public thinks there’s a recession coming, both businesses and people stop spending to prepare for the storm, which can lead to a recession.

If you’re feeling uneasy, you’re not alone. These are things out of our control so the best you can do is to prepare yourself for whatever happens.

Today, I’ll walk you through how I’m preparing for one.

Money Bulletin (News Highlights of the Week)

The latest data from the Bureau of Labor Statistics showed that the Consumer Price Index (CPI) increased 2.8% over the prior year in February, below January’s 3% annual gain and ahead of economist expectations of a 2.9% annual increase.

See which companies are reporting earnings today.

Food, medical care, and used cars remain elevated.

Preparing for a Recession

1️⃣ Don’t Panic

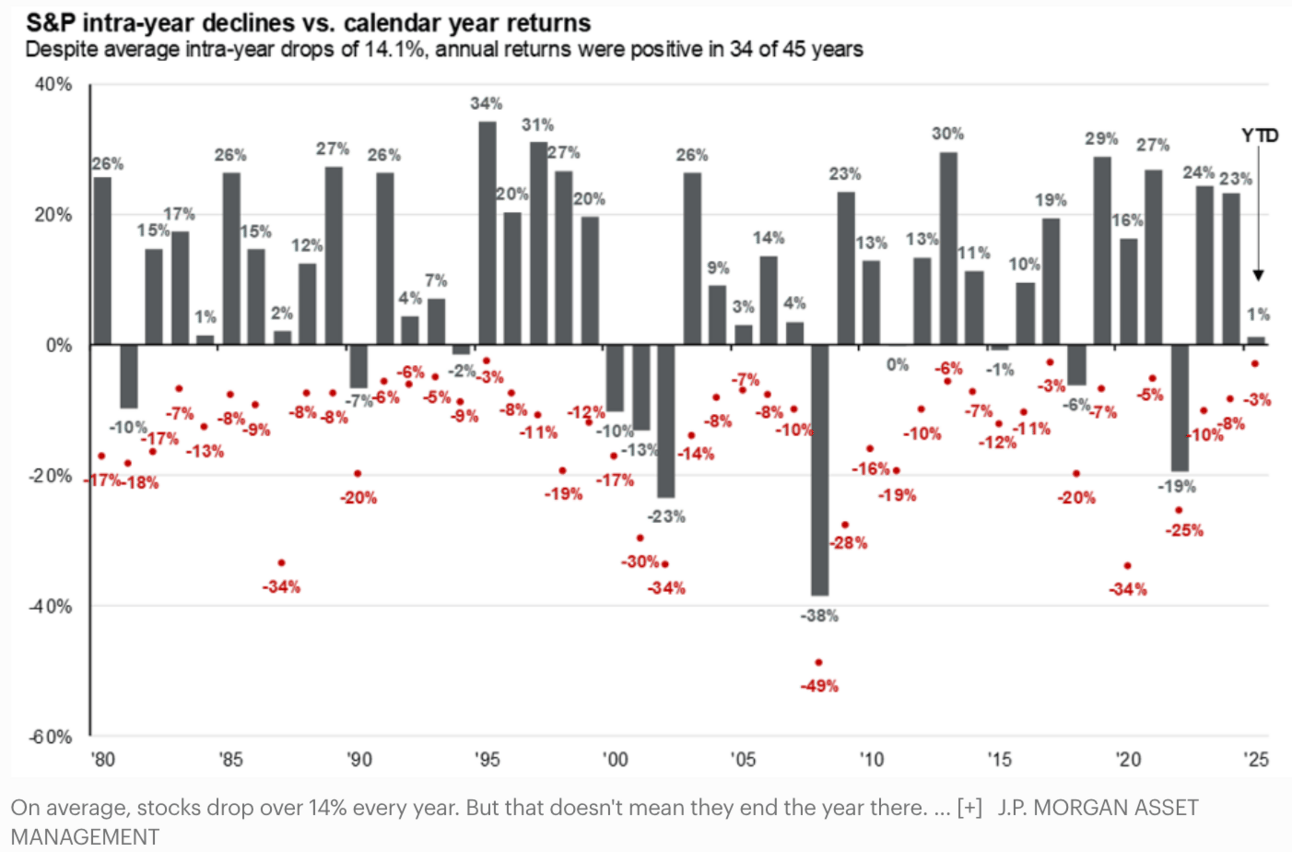

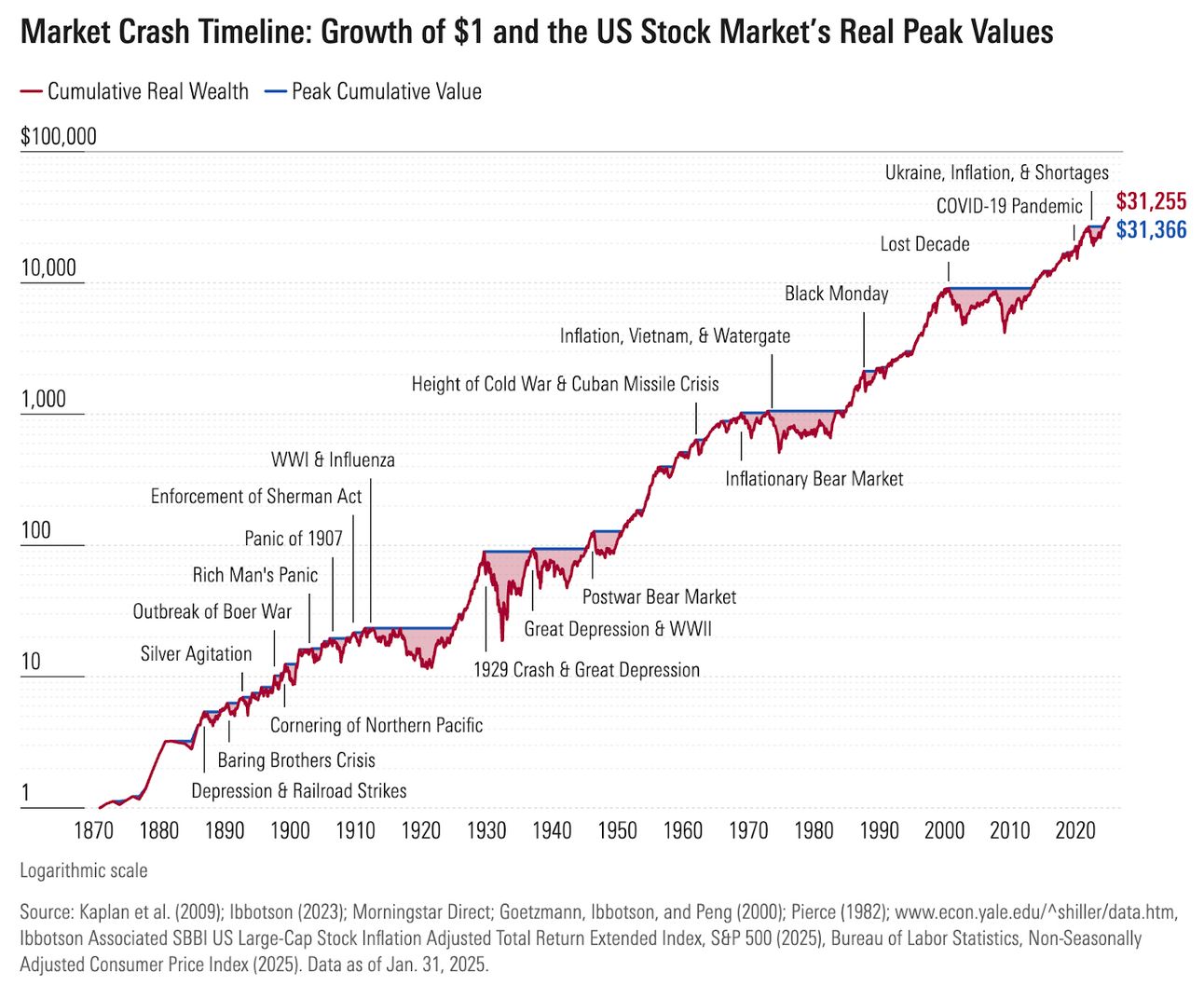

This ~10% correction might sting right now, but historically, it’s normal.

According to JPMorgan Asset Management, the S&P 500 has averaged a 14% intra-year decline, but still ended positive in 75% of those years since 1980.

Also, this just stings a lot right now because of how quick it happened. Remember the stock market crash from COVID-19? The initial downturn on March 9, 2020 was intense. The US stock market lost nearly 8% in ONE day. That COVID-19 crash led to a nearly 20% decline!

Remember the fear we all felt of how this could be happening? Yeah, that added another layer of panic.

But you might have forgotten the long and slow decline we experienced in the stock market more recently from the war in Ukraine, the rise of inflation, and shortages.

From December 2021 to March 2024, the stock market declined about 28.5% and we recovered!

To be honest, I almost forgot that happened.

What I’m trying to say is that this might feel uneasy right now because of how new and fast it’s evolved. Emotions play a huge role in investing, which I’ll get into next.

While I'm not panicking, I like to be extra cautious so I’m going to keep a closer eye on my spending as well.

📌 What I’m Doing:

✔ DON’T PANIC!

✔ Be mindful of my spending (tip: if you want to track your finances, read my review of popular budget apps here)

📞 Schedule a 1:1 consultation with me

I’m also opening my calendar again so if you want a 1:1 personalized consultation with me, you can schedule an appointment here.

2️⃣ I’m Sticking to My Long-Term Foundational Investment Strategy

My long-term foundational investment strategy is to put money away in ETFs and index funds. Any money that doesn’t go into real estate, a high yield savings account or any other investment, goes into my brokerage account.

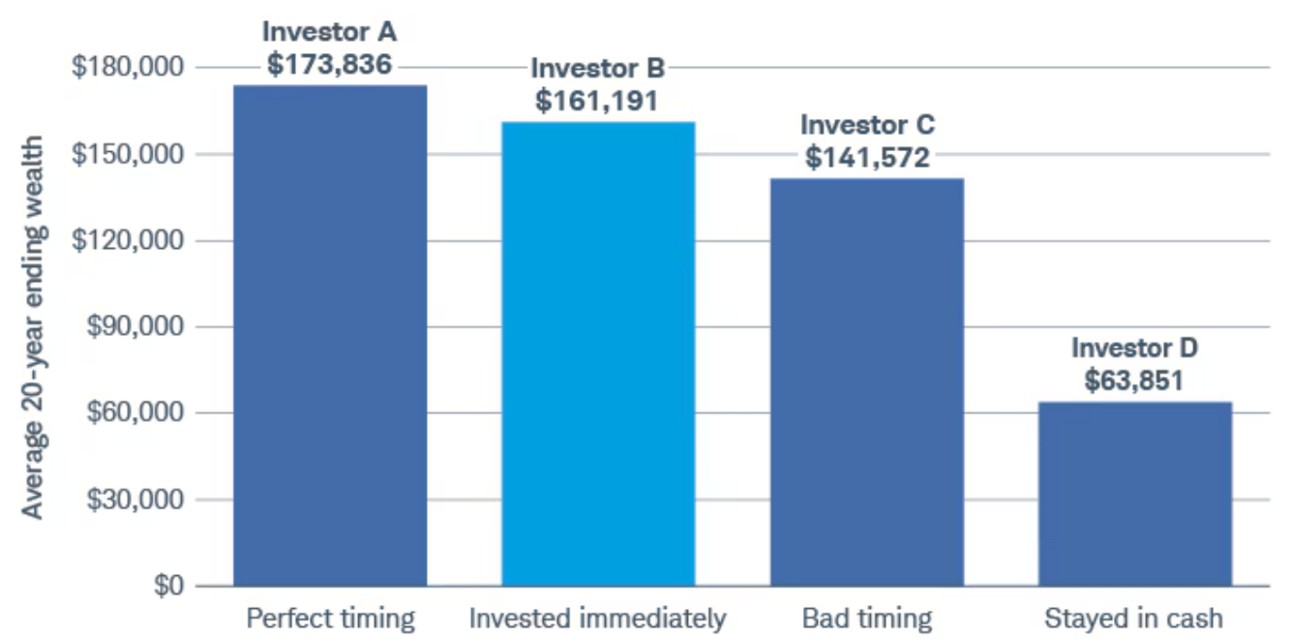

While you may be tempted to pick and choose stocks, most lose money. There are many studies that prove this. Investors who try to time the market take on more risk and make less money. Why add stress to your life and make less money?

Investing in an ETF or index fund is basically a foolproof plan if you plan to hold it for the long run. All you need to do is zoom out. To sum it up, staying invested beats timing the market.

A Charles Schwab study found that investing immediately paid off in the long run. In the study, four hypothetical investors invested $2,000 a year at once for 20 years.

While Investor A had the highest returns, it was BARELY higher than Investor B’s returns, which is surprising since perfectly timing the market each year for 20 years wasn’t THAT much better than just investing immediately at the beginning of every year.

So think of these dips as buying opportunities. Stocks are on a ~9% sale!

📌 What I’m Doing:

✔ Continue auto-investing in the stock market with 5% ($6,832.90) in my TSP (government retirement account), the maximum ($8,550) HSA contribution limit, the maximum ($7,000) Roth IRA contribution limit, and about $2,000 a month to my taxable brokerage, which is a total of $24,382.90.

3️⃣ I’m Keeping an Opportunistic Mindset

What Albert Einstein said is true, even for the stock market. The stock market has gone through crises and came out stronger.

There are notable investors who have done well following a crisis like Warren Buffett. Warren Buffett prepared for the 2008 Financial Crisis and invested heavily in the financial sector (specifically Goldman Sachs and Bank of America). He has done really well for himself because of that.

I often think about how my mom sold her entire retirement portfolio during the Financial Crisis. I only learned about this later when I was interested in investing. If she had left it alone, or better yet, invested more, she would have a lot more money for her retirement.

With no idea on how long it may take for the stock market to recover, I’m looking to stick to my long-term foundational investment strategy AND looking at new opportunities. A required piece to this is having capital ready to deploy (outside of your emergency fund). When an opportunity presents itself, I’ll be prepared to invest.

📌 What I’m Doing:

✔ Monitoring real estate markets—if it gets worse, real estate will likely follow.

✔ Keeping capital ready to deploy if we enter a deeper bear market and not going all in at once.

✔ Focusing on my income streams (my social media brand, my rental portfolio, and my new business)

Final Thoughts: This Too Shall Pass

Will the market drop further? Maybe. Will it recover? As long as the world is still “normal”, yes.

I like to think of myself as an experienced investor. I’m not panicking, I’m staying the course, I’m holding liquidity, and I’m always looking for opportunities.

If you stick with me, we can look back on this period and be wealthier together.

Let’s make this dough.