Hey all,

Welcome to a new edition of Spark to FIRE newsletter!

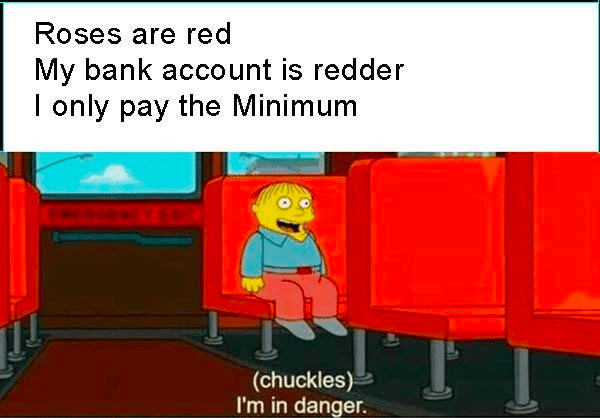

Americans are nearing $1 TRILLION of credit card debt, which is an all-time high! Given that credit card interest rates are 20+%, I think everyone knows that this doesn’t end well. I’m going to break it down in this newsletter.

And the big pending news about the debt ceiling and risk of default is circulating as the deadline for negotiations is coming before the US is guaranteed to default. The impact will be severe.

If you haven’t already, please subscribe to my Substack so you get notified of new posts!

As always, feel free to DM me on Instagram (@MillennialMoneyVeteran) or Twitter (@MoneyVeteran) on suggestions for the newsletter!

Related posts on this topic

Here’s a link to my site where you can read my blog posts on all things about personal finance, real estate, and financial freedom like:

Americans piled up $986,000,000 of credit card debt

Updated data from the Federal Reserve shows that American credit card debt is nearing a trillion dollars, which is an all-time high. During this time last year, the total credit card debt was $863,500,000. That’s over a 14% increase in one year!

What’s even more shocking is that in the 20 years that the Federal Reserve has been tracking this data, this is the FIRST TIME that the credit card balance didn’t decrease from Q4 to Q1. Credit card debt typically increases because of holiday shopping and consumers would later pay it off in Q1, but not this year.

It’s worth noting that there are factors in play that are likely driving the increased debt: inflation and interest rates.

Inflation

Americans are relying on credit cards to cover monthly expenses due to inflation. We’ve all experienced inflation in some way. Whether it’s housing, transportation, food, etc., our wallets are able to buy less than we’re used to.

Interest Rates

Credit card interest rates are not immune to the increase in the Federal funds rate. According to LendingTree, the average credit card interest rate in the US is 23.98%, which is the highest since LendingTree began tracking rates in 2019.

We know how damaging credit card debt can be. With increasing credit card debt, it’s not looking good for the economy as more disposable income will need to be allocated to paying off debt. This means less money for people to spend and invest, which will slow down the economy.

At this rate, I imagine we’ll hit $1 trillion in credit card debt by July.

White House Council of Economic Advisers publishes the economic damage if the US defaults

The US is expected to meet the deadline before its first ever default as early as June 1st. Obviously, it’s not an easy feat given how the two parties are so polarizing and the bill has to pass the House and Senate before the President can sign it.

The White House Council of Economic Advisers provided two scenarios: a brief default and a protracted default.

A brief default means the US passes the deadline and we’re in default, but it’s resolved within a week.

A protracted default means the US fails to raise the spending limits for more than a quarter - HIGHLY unlikely.

The White House Council of Economic Advisers says that a brief default would cause a loss of 500,000 jobs, which would be a 0.3% rise in unemployment. A protracted default would cause a similar effect like the Great Recession did - 8.3 million jobs lost and the stock market falling by 45%.

Moody’s Analytics shared the same concerns as well that you can read here.

Given that the US has never defaulted before, it’s imperative that policy makers come to a decision. If the US defaults, we now have a history of default and this worsens the world’s confidence in the US economy. We would have a negative score in our perfect record.

The US may default for the first time, but if it does, I imagine that it’ll be quickly resolved.

Thank you so much for being a subscriber! If you haven’t already, consider upgrading your subscription to a paid plan.