ADVERTISEMENT

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

THE BRIEF

Hey all, it’s MMV.

Would you prefer a $240,000 in-office job or a $120,000 remote one? This question had the internet debating between the tradeoffs of both decisions.

For me, the answer seems obvious, but the internet seems to be completely split in the middle.

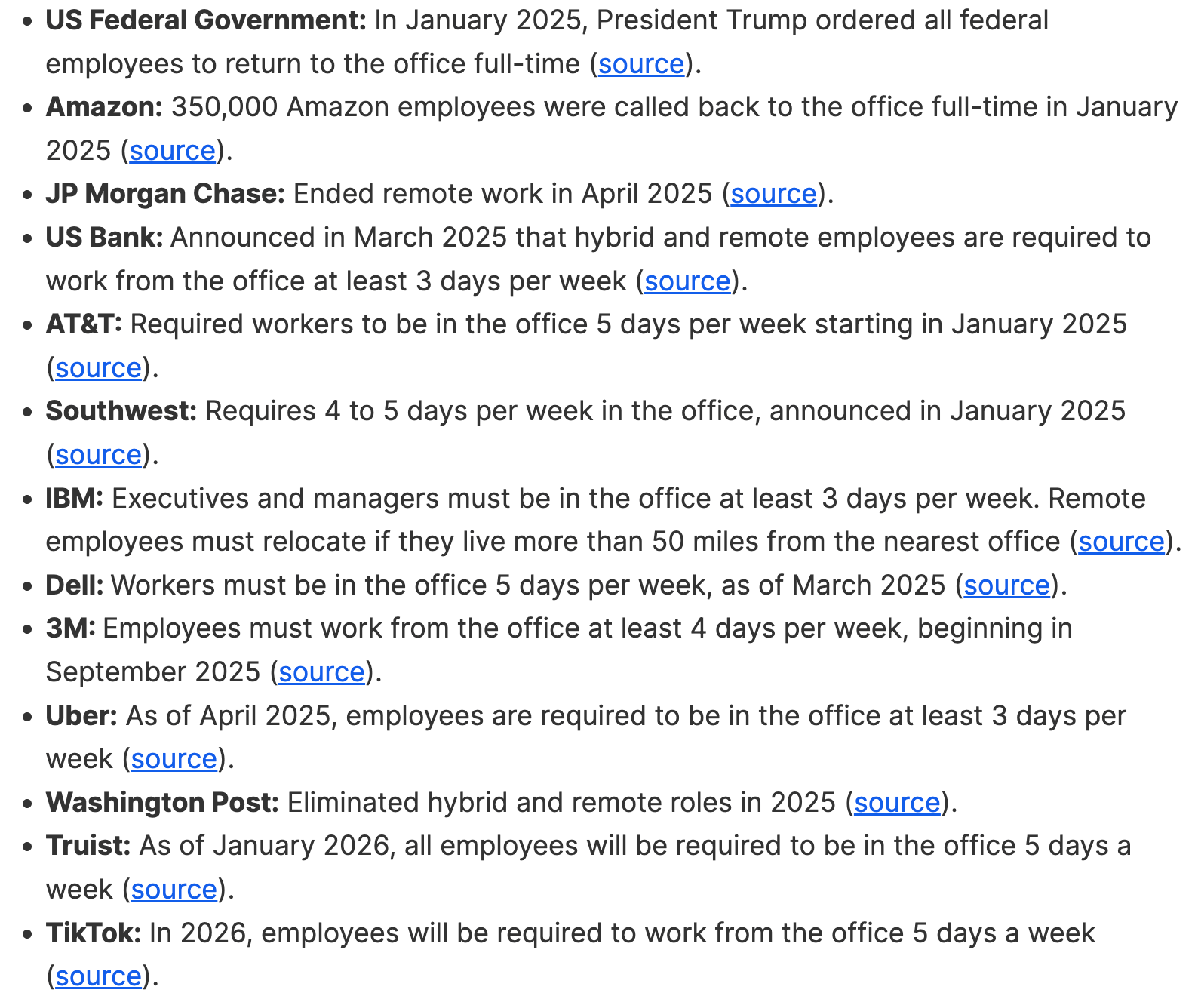

This is coming at a time as companies continue to enforce “return-to-work”.

RTO Effects

I’m going to break this question down and explain what I would choose.

I’m going to have a poll at the end of this post where you can answer which you would choose!

MY NEXT NEWSLETTER POST FOR MMV PRO MEMBERS

My next newsletter post is for MMV Pro members. You don’t want to miss this!

I’m going to share financial details of an Amazon employee, how his compensation is broken down with stock options, and his retirement plan to live a FatFIRE life.

If you’re interested in this kind of content, upgrade your subscription to read the whole post!

ADVERTISEMENT

Smarter CX insights for investors and founders

Join The Gladly Brief for insights on how AI, satisfaction, and loyalty intersect to shape modern business outcomes. Subscribe now to see how Gladly is redefining customer experience as an engine of growth—not a cost center.

RECENT NEWS

📈💰🌎 Business & Economy News

⛓️ DOJ launches criminal investigation into Fed Chair Jerome Powell

Powell put out a video saying he’s being targeted for not lowering interest rates. This man is the reason why we’re not experiencing higher inflation.

🇺🇸 The US economy added just 50,000 jobs last month

The latest data means 2025 saw the weakest annual job growth since 2003, with just 584,000 jobs added last year.

🪖 Trump threatens defense contractors with restrictions while promising sharp increase in spending

Defense contractors are slow to deliver and Trump is trying to put them in check. Also, he said he plans to increase defense spending to $1.5T.

THE BRIEF

👨🏻💻 The Internet is Divided Between $120K and $240K

This question blew up social media with the internet being divided on which they would choose.

To answer this question thoughtfully, you really have to be able to quantify the money, time, and lifestyle tradeoffs.

For some people, the extra $120K is life-changing and for others, the extra income isn’t enough to convince them to commute and lose flexibility of their schedule.

There are people who prefer in-office presence just because they enjoy the in-person collaboration and structure, but for this argument, I’m going to exclude those people.

This is assuming that people prefer remote, but would $120K in additional pay convince you to report to the office? That’s what this decision is about.

At its core, people are either choosing money and faster wealth-building or flexibility, time, and control over their daily life.

The $120K Decision

Being fully remote means you have more control over your day.

Your mornings can start with an extra hour or two of sleep or with a gym workout.

You don’t have to sit in an office or make small talk with colleagues or get involved in office politics.

The person who chooses the $120K option values the freedom to travel (working from another place), to live away from expensive metros, to plan days around family or health, and to avoid rush-hour commutes.

The $240K Decision

Let’s be real - you get a lot more money.

This makes maxing out retirement contributions much easier, increasing your savings rate (even with commuting and lunch costs) for a home, investments, or future financial independence. That’s huge..

Here’s what $240K can bring you:

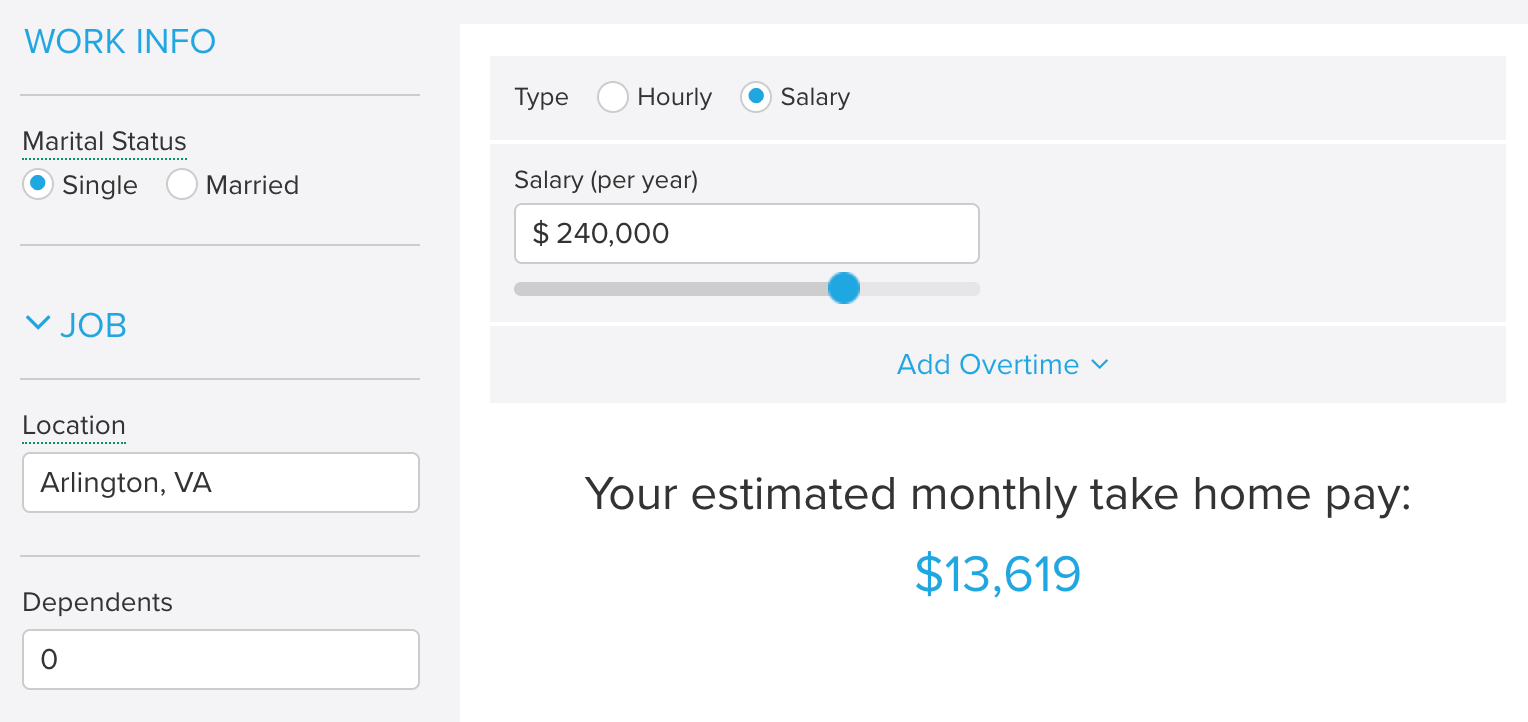

After federal and state taxes (before any retirement contributions), a person living in the DC metro would bring in $13,619 a month.

You can live a COMFORTABLE life (minus during work hours) with that kind of money while accelerating your retirement and cash savings by more than what most people can do.

$3,500 apartment? No problem.

BMW M3 lease? No problem.

Maxing out 401(k)? No problem.

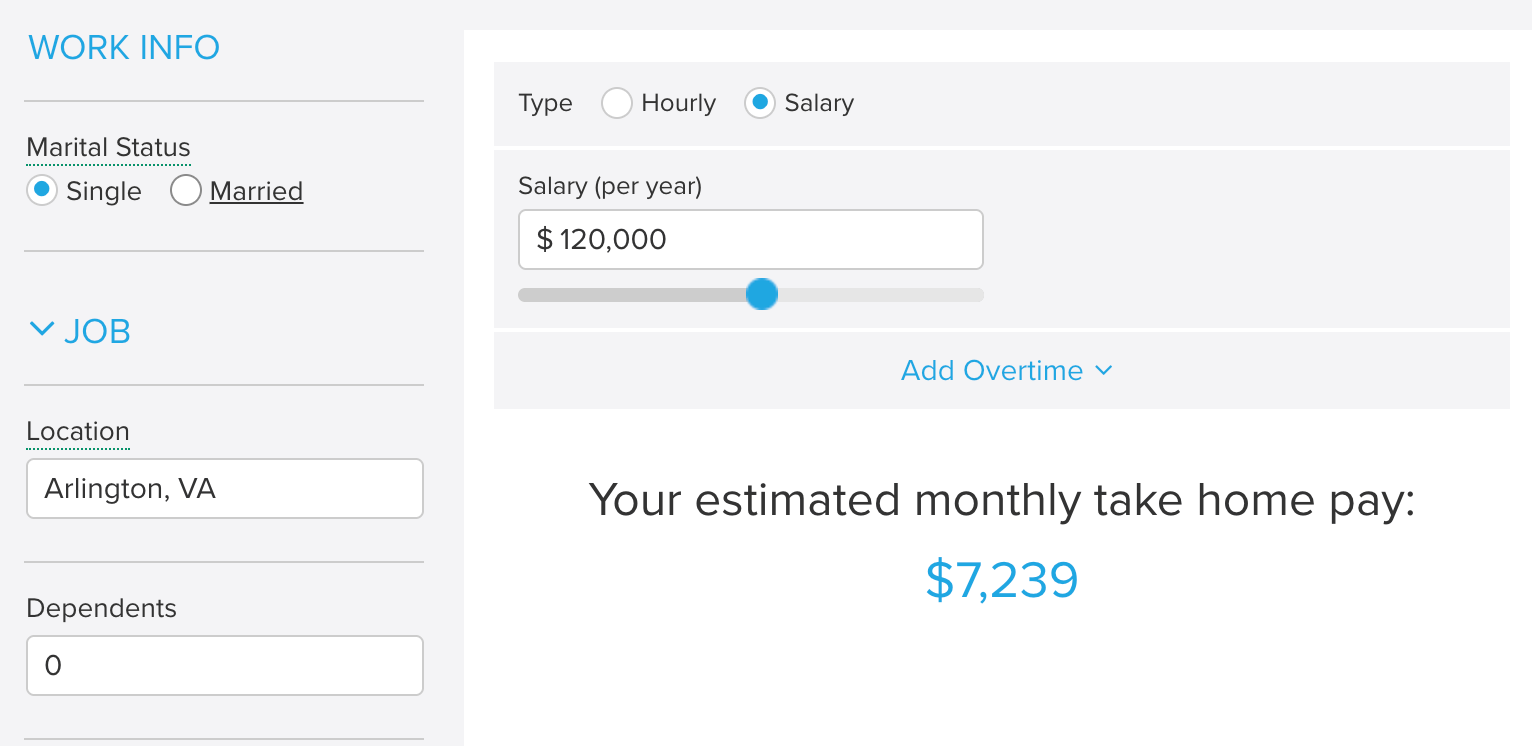

On the flip side, $120K can be plenty if you have low expenses.

Using the same location, a person making $120K would bring $7,239 a month.

Instead of a $3,500 apartment in a luxury building, $2,500 is on the lower end of apartments in this area.

A BMW M3 lease (maybe around $1,200) would be a poor financial decision. Stick with an older vehicle that’s paid off.

Even with these cheaper options, I would still personally have trouble maximizing my 401(k).

But with the option to live anywhere (especially a cheaper area), it can be very doable to maximize retirement savings.

What I Would Choose

Personally, I would choose the $240K option.

I might be biased right now because I currently go into the office 5 days a week and only get paid a little more than $120K so increasing my pay by $100K for the same lifestyle would be amazing and it doesn’t hurt to pad up the investment portfolio.

For me, the $240K option is such a big difference from $120K for me. Now, if the question was $120K remote or $180K in-office, I’d choose the $120K without a doubt, but somewhere between $180K to $240K is where my price is.

I’d love for you to participate in my poll at the bottom of this email.

However, here are questions and considerations I would ask you before you decide to participate:

How much does an extra 120k per year actually change your life over the next 5–10 years (debt, house, FI timeline)?

How bad is a full‑time commute and office presence for your health, relationships, and other goals, given commuting costs in money and hours?

How much do you personally value location flexibility and control of your schedule compared with job title or rapid net‑worth growth?

Would you have concerns of being remote in an area that doesn’t have many job prospects in case of layoffs given the current economic environment?

APP RECOMMENDATION

Best Budget App imo

📱Social Media Post of the Week

🛠️ Recommendations:

Real estate banking: this is banking service I use for my own real estate portfolio and I cannot recommend it enough!

Landlord insurance: get a free quote online for your rental properties

Short term rental insurance: protect your investment from disasters and bad guests

POLL

Participate in the Poll

$120 Remote or $240 In-Office?

Until next time,

MMV