My wife and I are finally heading to our honeymoon!

I posted this Instagram reel about how I booked our business-class flight to Japan (that was priced at $18,185 one-way) using points and I received a lot of DMs asking me how I did it.

The Brief

Booking Our $18,185 Business-Class Tickets

We wanted it to elevate our travel experience since this is our honeymoon after all. We were targeting a specific airline for this trip so this made the hunt for award seats more difficult and with the demand of tourists who want to visit Japan at all-time-highs, that made this even MORE challenging.

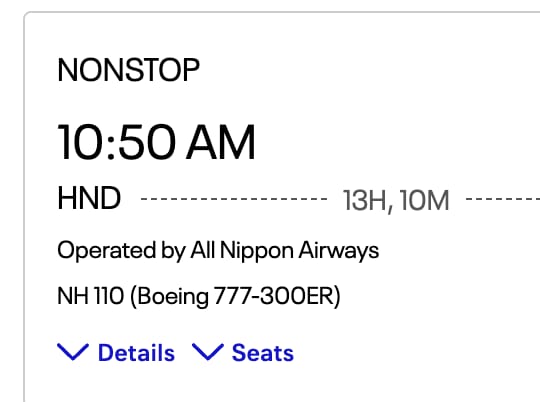

The specific airline we were hoping to fly with was All Nippon Airlines (ANA) due to its business-class seats.

ANA Business Class or “The Room”

This is actually going to be my FOURTH time flying in business class with ANA. It’s one of the best business-class products on the market (with Japan Airlines and Qatar beating it in this category imo).

The individual suites in business class make this feel like a first-class product. What a way to start off our honeymoon!

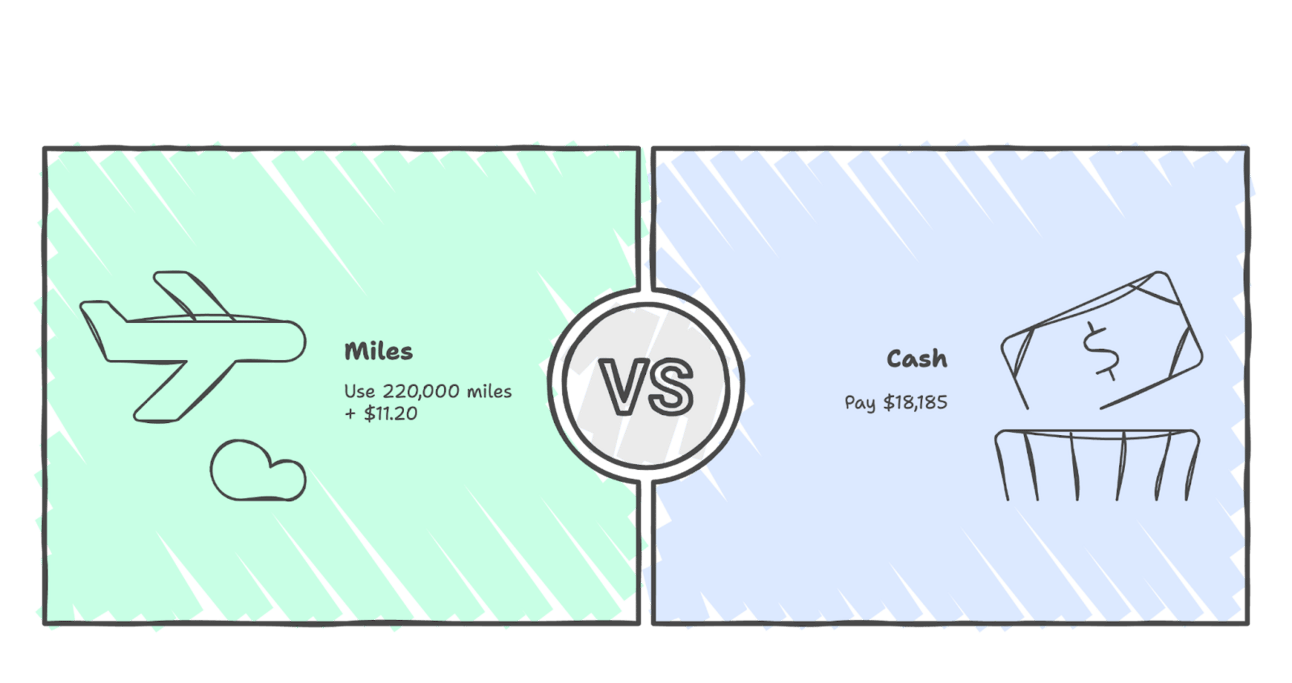

When I booked this flight, the exact flight would’ve cost me $18,185. I booked this flight for 220,000 points and $11.20. What a steal!

So how was I able to use points to book this flight?

First, I’ve been saving up credit card points since a decade ago. Since then, I’ve used my points sparingly here and there when it made a lot of sense to book with points vs with cash like for two of my previous experiences on ANA business class (I did pay in cash once).

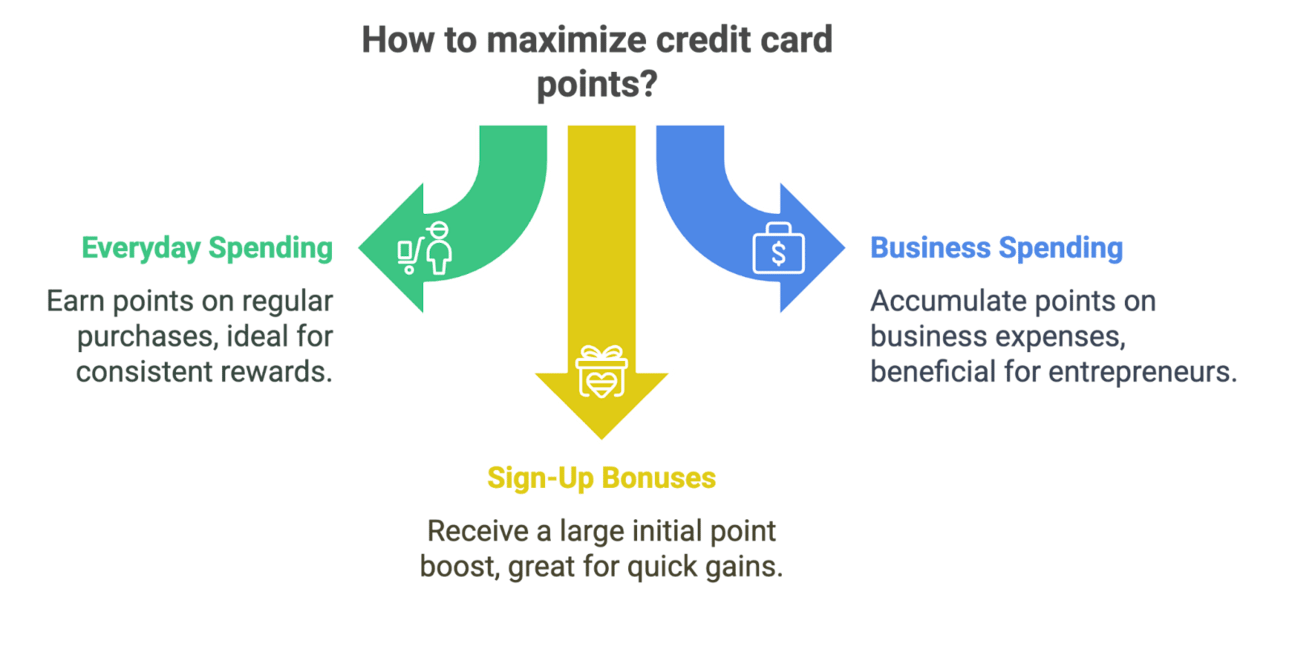

By using my card for nearly every purchase for both business and person and taking advantage of sign-up bonuses, I’ve been able to accumulate over a million points.

For a limited time, Chase released their best offer with their Chase Sapphire Preferred card of 100,000 points after $5,000 in spending within the first 3 months!

Warning For Those Interested In Credit Card Hacking

Now, I don’t recommend signing up for any card that has a sign-up bonus. If you’re part of my email list, you know that credit cards should be used with the intent of paying it off before you accrue interest because credit card debt is what I believe to be the gateway of bad debt due to the ease of use and high interest rates.

How I earn credit card points

There’s a whole community of people who “credit card hack” and make it their entire personality. That’s not necessary.

Credit card hacking is essentially optimizing your use of credit cards to maximize the value. My goal with credit card hacking is to use my credit cards with the intent to pay it off and to have points accrued to use to save money on travel and to elevate my travel experience.

Part of my strategy was to take advantage of the best Chase Sapphire Preferred (CSP) credit card offer in time for my trip to Japan. The $5,000 spend requirement to get 100,000 points will be easy to accomplish. Since I’m using a lot of points for my flight, earning back 100,000 points will be nice.

FYI, I downgraded my Chase Sapphire Reserve (CSR) to the original Freedom with Ultimate Rewards (can no longer apply to this card; only through downgrading can you get it) credit card, waited 3-4 business days, and then applied for the CSP. And you can have 2 Freedom credit cards

IMPORTANT: 1. I’m eligible for the sign-up bonus because it’s been more than 48 months since I received my first Sapphire bonus and 2. You cannot have 2 Sapphire credit cards so I had to downgrade my CSR, wait for the system to make that go into effect, and then apply for the CSP.

Recent News

📰 News Highlights

Map of net worth by state

An interactive map that shows the mean and median net worth in every state.China says it’s evaluating U.S. talks, hinting at possible thaw

Stocks back to all-time-highs?!Apple has managed tariffs so far, but Cook lacks long-term answers

Not sure what people expect from Tim Apple (pun). Tariff policy has been changing constantly and Apple has already began focusing their supply chain in India and Vietnam.

Recommendations

🔧 Toolbox

Best bang-for-buck travel credit card (link): I’m using this credit card to get 100,000 points and not having to pay foreign transaction fees while I’m abroad. Plus Visa is widely accepted in Japan.

Real estate banking and rental management platform (link): If you have any rental properties, this is the platform you should be using. Every transaction that happens within my portfolio shows up in bookkeeping and I can link external accounts like my credit card so it auto-imports. Best of all, my tenants can automate rent payment.

Form your LLC the right way without fees other than the mandatory state fees (link): I’ve used this to form my LLC for Sitting on Dough. It’s free and avoid me having to navigate outdated state websites 🤮

Spending

How I’m Using My Credit Card Points To Save Money and Elevate My Travel Experience

Flights

The price of those two tickets was $18,185 but instead, I transferred 220,000 Chase Ultimate Rewards points and paid $11.20 for that same flight.

Which would you choose?

The value of the 220,000 Chase Ultimate Rewards points is the equivalent to $2,200 in cash back or $3,300 in travel redemption through Chase.

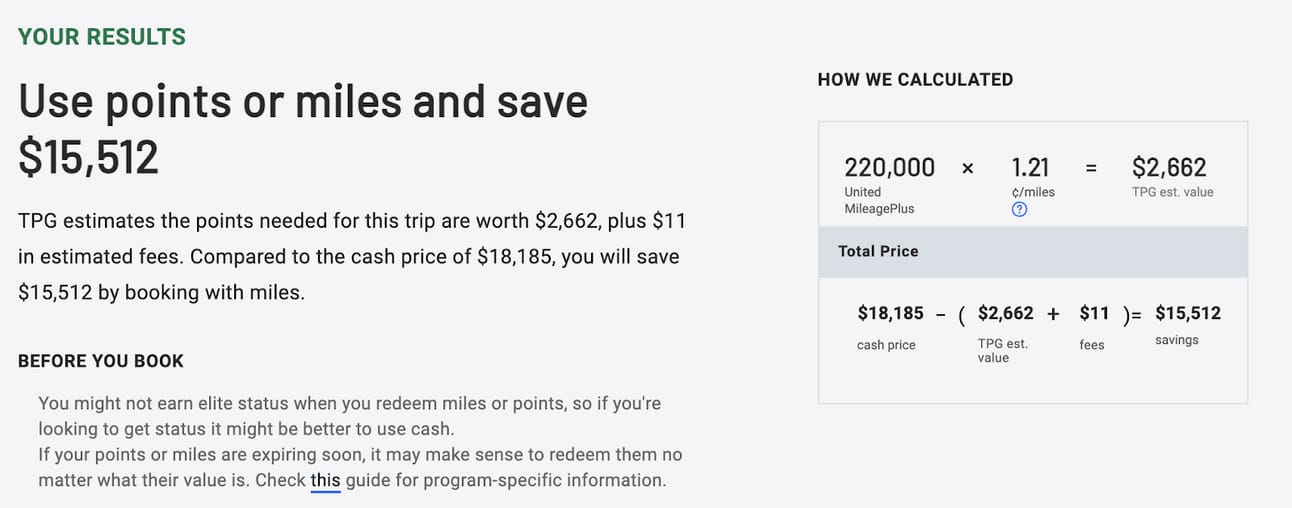

The travel and credit card points website, The Points Guy, suggests that I saved $15,512.

If I used those 220,000 credit card points to redeem travel booked with Chase for a value of $3,300, I would’ve still had to spend nearly $15,000 on this flight. The reason why I was able to get 5.5x that value was because I transferred it to one of Chase’s travel partners which is the best way to maximize your redemption.

To book this ANA flight, I searched on the United Airlines website for award bookings using the “Search with Miles” feature. United Airlines is a partner airline with ANA so ANA award seats will show up if it’s available with “operated by All Nippon Airways”.

From the United Airlines site

With how much demand there is, you really have to check multiple times a day. Award seats usually show up either 300+ days out or within 14 days out from departure.

Because I didn’t plan to go to Japan almost a year ago, I had to be flexible and book my flight within 2 weeks of departure. Worst case, we would’ve booked a cheaper business class flight with cash through ZIPAIR, Japan’s budget airline, or even book economy.

And I’m doing the same thing on the way back. Because my honeymoon is 3 weeks, I don’t have a return flight yet. I’m going to book it after my first week in Japan. However, I will book an economy seat using points so I have proof of a departure flight for when I go through immigration but thankfully, United Airlines does complete refunds for award flights (whew). I imagine that the return flight would cost nearly the same as our flight to Japan. Worst case, we take an economy flight back.. I know.. First world problems.

Hotels

For half our trip, we’ll be staying in Japanese hotels and the other half will be in Marriott and Hyatt. While I could’ve used points to book ALL of them and essentially have a zero out-of-pocket expense for hotels, we wanted to maximize convenience and value.

As we’re traveling to several different cities, we wanted to stay in certain areas that made sense with our itinerary so we didn’t have to travel to get to EVERY spot on our list. Some Marriott and Hyatt hotels were not located in those areas so we opted for Japanese hotels. We were okay paying for it as well.

I did book a Hyatt hotel that would’ve cost me $650+ a night (yes, Tokyo is expensive) but I used my points and booked them for 32,000 points per night. I rarely use Hyatt but I’ve had these points from past Hyatt stays and we wanted to stay in Shibuya for the last part of our trip so that saved us a lot.

Total spend on hotels for nearly 3 weeks in Japan cost me $3,100.

Transportation

We’ll be using the airport shuttle to get to and from the airport and public transportation. Just from the bullet train travel alone, we’re spending $720.

Food

No budget for this. I’ll just be swiping my Chase Sapphire Preferred card since there are zero foreign transaction fees.

Estimated Cost | Actual Cost | |

|---|---|---|

Flights | $36,370 | 440,000 points + $124.82 (higher fees leaving Japan) |

Hotels | $4,400 | $3,100 |

Public Transportation | ~$1,000 | ~$1,000 |

Food | ~$2,500 | Probably $3,500 |

Watches | ~$5,000 | Probably >$5,000 |

Total | $49,270 | >$12,724.82 (and 440,000 points) |

Be sure to check my Instagram to see me on my honeymoon!