Hey, it’s Millennial Money Veteran,

It’s the second issue since I changed newsletter platforms and I’m getting the hang of the new format. In this one, you can read about:

the reality of tariffs

some interesting recent articles I came across

recession-proofing your finances

how I’m recession-proofing

Let’s get into it.

The Brief

The Reality of Tariffs

Since President Trump’s tariffs became a threat, stocks have been severely impacted. Investors fear a prolonged trade war which will affect corporate profits and the economy.

Pre-market movements indicated that yesterday was going to be a bad day in the stock market with tariff tensions continuing and low confidence across the world on achieving a resolution. The day ended pretty good relative to where it started (basically minimal change from the previous day). Today was a sign of hope and then turned back to disaster.

As someone who studied economics and graduated with honors (incoming humble brag: was in the top 10 of econ major graduates), this is really interesting to me because we get to see economic theory play out in a case that probably has never been done before in this fashion.

Instead of letting journalists tell why these tariffs are bad, I’ll share my take on this.

If tariffs act like a tax and end up hurting consumers, why use it?

Countries use tariffs as a tool to protect domestic production by reducing foreign competition. There are legitimate reasons to impose tariffs. Imagine if the US no longer produced steel and everything had to be imported. This would be a huge concern since steel is used in so many areas like infrastructure, defense, shipbuilding, energy, etc. and being dependent on other countries for steel that can be influenced by a country’s leadership is a very vulnerable position to be in. In my opinion, THIS is the most important reason why tariffs are and should be used. The added bonus is that the government generates revenue from tariffs.

In this particular case with the Trump tariffs, the biggest risk is causing a tariff war and significantly disrupt trade. The saying that “tariffs are a tax” has been repeated nonstop across the media. It’s true because that’s the eventual outcome.

Tariff wars (especially with China) are not good for ANYONE. It becomes a d*ck measuring contest and seeing who folds first. While that contest goes on, industries and consumers are disproportionately impacted and become collateral damage.

Recent News

📰 News Highlights

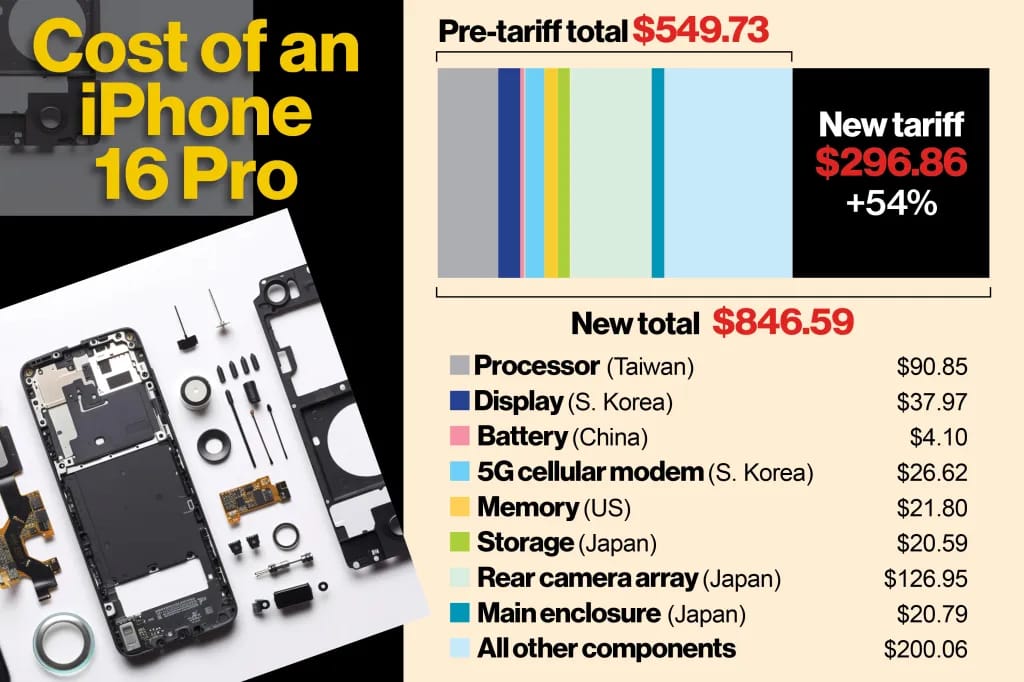

Here’s how Trump’s tariffs could send iPhone prices over $2,000 —as Apple’s costs may surge by 54%

That’s just Apple’s cost. Imagine the retail price. The suggestion to hire tiny-screw-screwers in America instead of China could bring the cost to assemble an iPhone up from around $30 to $300One chart shows how much optimism has been wiped out of the 'Magnificent 7' because of Trump tariffs

Magnificent 7 is known for its high P/E ratio. Is this the catalyst we needed to bring isane valuations down?Jamie Dimon’s Letter to Shareholders

He talks about a bunch of different topics but he believes tariffs will drive inflation up and slow growth.

Continued Brief

This is for the naysayers who say tariffs are not a tax:

Imagine tariffs didn’t exist. That American-made clothing made in a US factory paying US utilities and wages costs $30 to make. The company charges customers $70. Meanwhile, Vietnam makes similar clothing, but it only costs $8 to make. The company charges $50 for that piece of clothing to US customers. More people will buy that $30 piece of clothing from Vietnam. With lower demand, the clothing manufacturer struggles to compete and lays off workers and eventually shuts down.

In this case, consumers SAVE $20.

Now, imagine a 40% tariff is imposed for imported clothing from Vietnam. That 40% would make that $50 piece of clothing $70. The government makes $20 and the consumer now has to pay $70, which makes it $20 MORE than they would’ve paid without tariffs. Domestic companies can now compete on a level playing field. Tariffs act as a hidden tax since the consumer ends up paying it and that money gets into the government’s hands indirectly.

And no, companies will not be lining up to manufacture in the US unless they have the capital and the capacity to do so. Automakers are more capable of doing this since they already have some production here in the US, but a clothing manufacturer? Yeah right.

The reason those jobs were outsourced to begin with is because our economy transitioned from manufacturing to innovation and service-based industries. Good luck paying people enough to screw in iPhones when we, as a country, don’t even want to pay minimum wage workers a livable income. And I’m not sure if the majority of Apple iPhone users are willing to pay more than double today’s iPhone price.

While I’m all for the US maintaining some manufacturing capability, not every manufacturing job is the same. Our economy has evolved to the point that these types of jobs just do not pay the bills. In the 1970s, a manufacturing job paid well enough to live a modest lifestyle. This job might be enough to pay the bills somewhere else, but not here anymore.

The US went through an industrial revolution many years ago. Some countries are going through their own industrialization right now, which is why manufacturing capabilities in those countries exceed ours (since that is not our economy’s skill set anymore). Why would it make sense to bring back manufacturing when it costs more, is less efficient, and less capable?

Source is from WSJ

China did take manufacturing jobs to assemble the iPhone, but it’s a very small part of the process. Would you rather have the intellectual property and the other major components or the actual job of assembling the iPhone? Plus outsourcing that job helps consumers and Apple with a lower cost and wider customer base. It’s a win-win-win situation.

Unfortunately, this is very much a blanket tariff policy with very few exceptions. The silver lining is that the U.S. has A LOT of negotiating power so I can imagine many countries are willing to negotiate. Imagine if we were just an emerging market and we decided to stir up the global economy like this 😀

This is ultimately a gamble - in the end, we’ll get a mixed bag compared to what we started with. Some things will have higher tariffs, some will remain the same, and some will go down (maybe to zero). This is why many companies like Levi, Volkswagen, and many more are waiting till the dust settles. Negotiations are actively happening and updates are happening hourly. Until the dust settles, we won’t know the lasting effects and until then, consumers will be impacted.

The uncertainty of how these tariffs will impact real life has led to the NASDAQ and S&P 500 to touch correction territory as this has been the biggest drop since COVID and the worst three-day performance for the S&P 500 since October 1987. While the market was up today (and then went back down), there is still the possibility that things do not end well and the risk of a recession increases (Goldman Sachs increased odds of recession to 45%) .

Of course people are panicking. It’s natural when you see what you built over years drop 20% in a matter of days. But, emotional decisions when it comes to money often don’t work out well. It’s important to remain level-headed and stick to the fundamentals.

Here’s the reality: you cannot control how the market performs. People will do one of two things - either you’re crying or you’re buying.

See this clip from the movie Margin Call that I posted:

Ultimately, we are just in it for the ride (hopefully, up).

The only thing you CAN control is how you prepare and react.

Recommendations

🔧 Toolbox

This section will showcase the tools I use for anything. I love trying new things so I’ll share what I’m using and why:

Business credit card (link): Every business needs a business credit card to make purchases for the business. It also makes it a lot easier for bookkeeping.

Real estate banking and rental management platform (link): If you have any rental properties, this is the platform you should be using. Every transaction that happens within my portfolio shows up in bookkeeping and I can link external accounts like my credit card so it auto-imports. Best of all, my tenants can automate paying rent.

Navigating Life

How To Recession Proof your Finances

If you’re someone who wants to be prepared when a recession happens (it will - it’s just a matter of when), then you want to take these actions:

Increase your emergency fund

The typical advice regarding emergency funds is to have 3-6 months of living expenses. It doesn’t hurt to beef up your emergency fund for 6-12 months. During a recession, you can expect layoffs to increase and new job postings to decrease so I rather have more cash on hand than in the market because the cash is liquid and I view investments in the stock market as long-term investments so I wouldn’t want to liquidate.

Keep your emergency fund in a high yield savings account like Wealthfront for a 4% APY savings account (and 4.5% APY for 3 months as a new account holder).

Lower spending

This should come as no surprise. Lower your spending on luxuries and unnecessary purchases so you can build up your emergency fund and deflate your lifestyle based on the additional risk in the economy. I use Empower to review my finances so I don’t stray too far.

Avoid bad debt

I don’t need to dive too deep into this since my readers are typically past this stage but avoid debt, especially variable rate debt like credit card debt since those rates are high and can change (for the worse).

Now, these are all basic recommendations. Here’s the next level to recession-proofing your life:

Stay employed

If you currently have a job, aim to keep it! What I mean by this is do not give your employer an excuse to let you go. As a government employee, I’ve been sending in 5 bullets on what I did in the previous week. Because I don’t want to get laid off for some ridiculous reason, I’ve been writing up 5 unique bullets each week before the deadline. It can be as simple as not arriving late or consistently proving that you are a contributing team member. You can take it a step further by upskilling or taking on additional responsibilities.

Build something to monetize

Easier said than done, but what better way to protect yourself from everything that comes with a recession than to build a lean business that makes you money! This could be something you already do (maybe as a hobby) or something you want to try!

I know someone who makes candles at home and sells them at farmers markets on the weekends.

I also know someone who makes earrings and sells them online and at farmers markets.

As for me, I’m investing time into my content, newsletter, and email list. This is my foundation to building a community. I’m working on monetizing my brand better while still providing high quality content. This means spending some money on new software like this newsletter platform for a better experience and monetization opportunities.