I’m Millennial Money Veteran and I created this roadmap because when I started my FIRE journey, I couldn’t find any advice that felt realistic for normal people like me.

Like how do I, as a person living paycheck-to-paycheck save enough to retire in my 30s?!

Most of the FIRE stuff sounded like you had to live on $20k/year, live with roommates, and eat cheap food all the time. I started living this way, but I never reached the extreme levels because I realized that I wanted to enjoy my life while living it. My reason for FIRE-ing was because I just wanted options: to work because I want to, not because I have to.

I figured out my own plan by doing one simple thing: having a routine or system to keep moving the needle forward.

If you’re just learning about FIRE, it might seem like A LOT of information, but it’s simple once you get used to the lingo.

That’s why I made this starter kit so you can get started TODAY with the information you need to know and exactly what to do to start. It’s meant to be tactical action items that you can do right away.

You’ll be way ahead of your peers just by knowing this information.

What is FIRE?

FIRE stands for Financial Independence, Retire Early. It's a lifestyle movement focused on aggressive saving and investment strategies that allow individuals to accumulate a substantial nest egg, which enables them to retire much earlier than the traditional retirement age.

The point of FIRE isn’t about quitting work ASAP - it’s about having the freedom to choose how you spend your time, sooner than traditional retirement age.

There are several different types of FIRE. You can read the different types here.

The traditional FIRE method is to build a retirement fund that will cover your living expenses for the rest of your life. It’s basically normal retirement (save enough) but accelerated.

The core principle of FIRE is to minimize expenses and maximize income to achieve a high savings rate. This saved capital is then invested, typically in a diversified portfolio of stocks and bonds, to generate returns that will sustain living expenses once you do choose to retire early.

For most people, that means:

• Spending intentionally.

• Saving and investing aggressively but realistically.

• Knowing your numbers and adjusting as life changes.

This starter kit shows you exactly what to calculate and gives you free tools to do it right.

Benefits of FIRE

Freedom and Flexibility: FIRE provides the freedom to pursue passions, spend time with loved ones, and control your own schedule.

Reduced Stress: Financial security reduces stress related to work, bills, and the future.

Purposeful Living: FIRE allows you to focus on activities that bring meaning and fulfillment to your life. For me, it’s creating content and building a business around it.

Early Retirement: The most obvious benefit is the ability to retire much earlier than traditional retirement ages. This means no more commuting to a job you don’t enjoy working. I hit LeanFIRE in my early 30s but I chose to go back to work because knowing that I wasn’t dependent on a job made it more enjoyable (weird, right?) and I wanted to live a FatFIRE life so now, I don’t stress about saving every dollar or have a goal oriented on money in mind. I just want to live comfortably and enjoy the finer things in life that I sacrificed early on.

Increased Resilience: Having a substantial financial cushion provides resilience in the face of unexpected life events. Suddenly lost your job? Good thing you have substantial savings until you figure things out.

🔑 The 3 Key Numbers for FIRE

The whole FIRE plan boils down to 3 numbers:

Your annual expenses: How much you actually need to live your desired life.

Your FIRE number: How big your nest egg needs to be to fund those expenses forever.

Your timeline: When you want to reach it and what you’ll have save and invest to get there.

Tip: There is a checklist at the end so you can take immediate action today to set yourself up.

🪜 Steps to Achieve FIRE

Calculate Your FIRE Number: Determine the amount of money you need to retire comfortably. Multiply your annual expenses by 25 (based on the 4% rule). For example, if you need $40,000 per year, your FIRE number is $1,000,000. You can use my FIRE Calculator here. The 4% rule assumes a 30-year retirement. If you plan for a 40-50 year retirement, a 3.5% or even 3% would be safer.

Understand Where Your Money Is Going: Monitor your spending to identify areas where you can cut back. This means looking at your bank statements and calculating where your money is going. For me, this meant no eating out and selling my condo to live in a shared apartment.

Create a Budget: Develop a budget that aligns with your FIRE goals. I have a Budget Calculator that follows the 50/30/20 budget framework. With your budget, you should prioritize saving and investing. When I first started, I kept all my expenses below 50% of my take-home pay and invested nearly everything else. I basically had a 50/5/45 budget.

Increase Your Income: Explore opportunities to increase your income through promotions, side hustles, or starting a business.

Invest Wisely: Invest your savings in a diversified portfolio of low-cost index funds or ETFs. Here’s an “Investing 101” blog post that’s like a cheat sheet.

Automate Your Savings: Set up automatic transfers or create a schedule to transfer money from your checking account to your investment accounts.

Re-evaluate Regularly: Review your progress regularly and adjust your strategy as needed. Life changes (job change, relocation, etc.) and so do your expenses. Questions to evaluate your finances should be:

🔹 Are you saving enough?

🔹 Has your income changed?

🔹 Are your investments on track?

Example: FIRE at 50

Let’s say you spend $50,000 a year and want to stop working at 50.

Your FIRE number = $1.25M ($50K x 25 from the 4% rule)

If you’re 30 now, you need to save ~$30K a year at 7% return.

Tip: Run your exact scenario using my FIRE Calculator

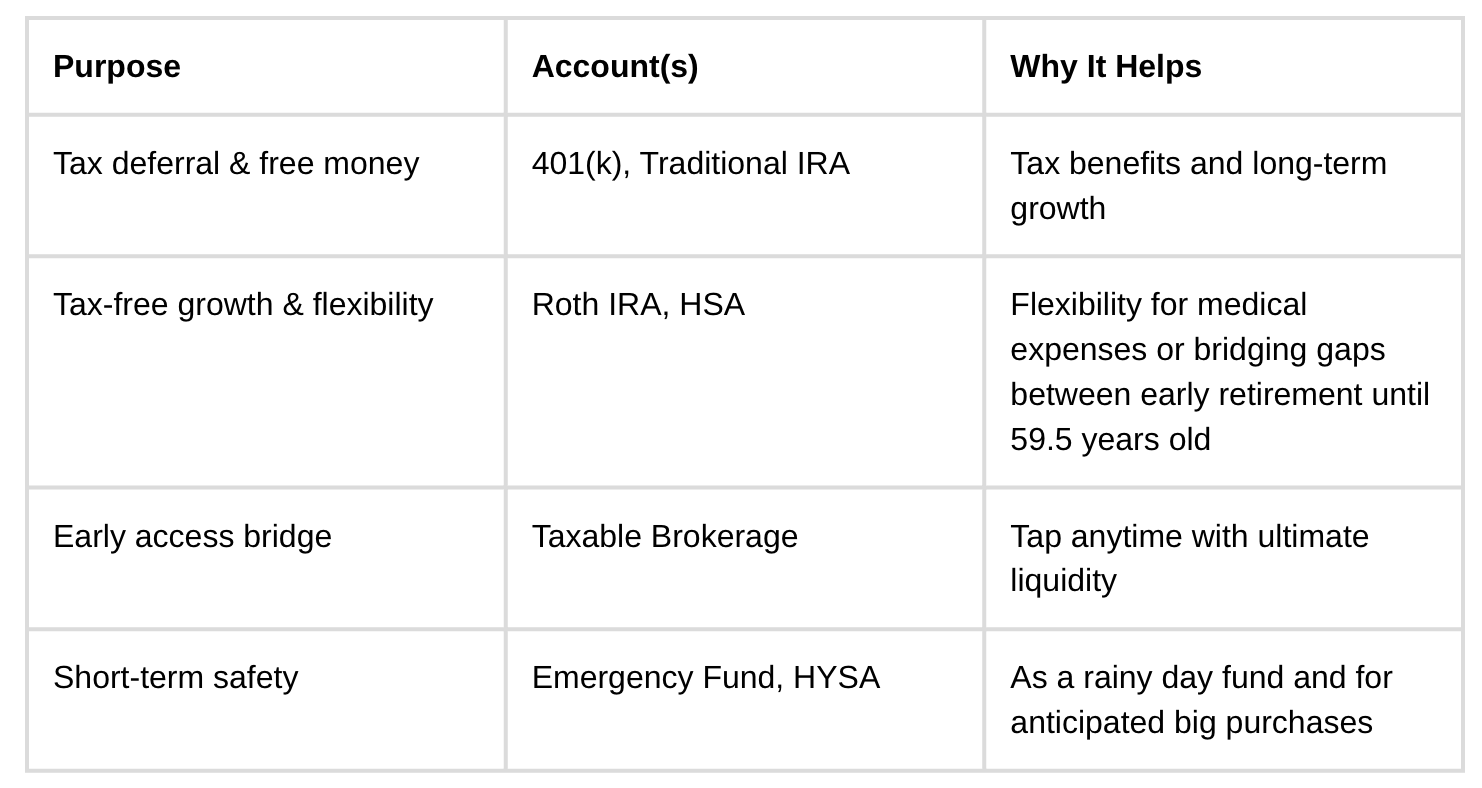

🏦 Important Accounts to Have

401(k) or 403(b) Account: Employers often match an employee’s contribution which is free money. With the option to have a Traditional 401(k)/403(b) account, your contributions reduce your taxable income now and grows tax-deferred until withdrawal at 59 ½. With a Roth 401(k)/403(b), your contribution is taxed now so it can grow until you withdraw at 59 ½ without paying taxes then.

👉 Use my free 401(k) Growth Calculator to see how your retirement plan compounds.

Traditional or Roth IRA: Similar to the above but not tied to an employer’s plan. It offers a lot more flexibility in where you can invest. Roth IRAs are great for early retirees since contributions can be withdrawn at any time penalty-free. There is an annual limit to how much you can contribute to this account every year.

(OPTIONAL) Health Savings Account (HSA): This account has a triple tax advantage where contributions lower taxable income, grows tax-free, and withdrawals are tax-free for medical expenses. This account requires the holder to have a high deductible health plan. This account also has a yearly limit.

Taxable Brokerage Account: This account is the most flexible account and can serve as a “bridge” account for your early years until you’re eligible to withdraw from your retirement accounts at 59 ½ years old penalty-free.

High Yield Savings Account (HYSA): This account is perfect for your emergency funds (typically 3-6 months of expenses) while earning higher interest than you would in a checking account. → HYSA ← This is the HYSA I use.

⚙️ Recommended Order of Operations

Disclaimer: This is just a recommended rule of thumb to follow, not the absolute best way for everyone.

1. Get 401(k) match in your employer’s 401(k) or 403(b) or TSP match first.

Example: If your company matches 100% of your first 5%, contribute AT THE MINIMUM.

It’s free, instant return. Don’t leave that on the table.

2. Build 3–6 months HYSA

This should be 3-6 months of your monthly expenses. This is a rainy day fund. Things happen like a car breakdown or job loss.

3. Max Roth IRA / Traditional IRA (it’s $7,000 for 2025)

Roth IRA is popular for FIRE: pay tax now, grow tax-free forever. If your income is over $150,000 or more, use the backdoor Roth IRA method.

Traditional IRA = tax break now (reduces your taxable income).

4. (Optional) Max HSA if you have a high-deductible health plan

Max out your Health Savings Account (HSA).

Triple tax advantage: pre-tax in → grows tax-free → tax-free out for medical expenses. Keep those receipts as there’s no time restrictions.

Many FIRE folks let this grow as a stealth “medical retirement fund.”

5. Contribute more into your 401(k) or invest in a taxable brokerage

Taxable brokerage is crucial for early retirees because you can tap into it at anytime. If you retire early, a taxable brokerage acts as a “bridge account” to cover the gap until you can touch 401(k)/IRA money penalty-free.

More into your 401(k) has tax benefits (either now or later) but has restrictions on when you can withdraw without penalty.

6. Open a 529 or a separate savings account for separate goals if applicable

Consider a 529 Plan for education savings (tax advantages vary by state).

Have a separate savings account for short/mid-term savings like a house payment, sabbatical fund or a special gift for yourself like a watch!

Now, these are the basics. Start with what you can and work your way to reaching all the steps that make sense for you. I wasn’t able to do half of these when I first started and I still don’t. For example, I don’t have a 529 account and I don’t contribute more than my employer’s match into my 401(k) for my own reasons.

Considerations

While FIRE offers significant benefits, it's important to consider potential drawbacks:

Lifestyle Changes: Achieving FIRE often requires significant lifestyle changes and sacrifices.

Market Volatility: Investment returns are not guaranteed, and market downturns can impact your portfolio. It’s important to understand that the stock market goes through cycles, but the principles of FIRE stay true.

Inflation: The cost of living can increase over time, potentially eroding the purchasing power of your savings. If you want to maintain your current lifestyle, your expenses will rise due to inflation.

Unexpected Expenses: Unforeseen expenses, such as medical bills or home repairs, can impact your FIRE plans. It’s important to have an emergency fund.

Poor investment choices: Poor investment returns early in retirement can significantly deplete your portfolio. Most traders lose money from day trading and it’s important to have a diversified portfolio, which can easily be achieved with an index fund.

✅ Here’s the Checklist

Know Your Core Numbers

1. Calculate Your Annual Expenses

Figure out how much you really spend each year to live the life you want. Be honest — not just the bare minimum.

➡️ Use my free 50/30/20 Budget Calculator to break it down. Plug in your numbers below:

Needs (50%): | |

Wants (30%): | |

Savings/Debt Payment (20%): |

2. Find Your FIRE Number

Multiply your annual expenses by 25 to get your target nest egg using the classic 4% rule (or down to 3% if you want to be really conservative)

Example: $50,000/year × 25 = $1,250,000.

➡️ Run different scenarios with my Traditional FIRE Calculator.

3. Pick Your Timeline

Decide what age you want to hit your number and see how much you need to save each year to get there.

Ideal Retirement Age | |

FIRE Number |

Optimize How You Save

4. Follow the “Recommended Order of Operations” On Where to Put Your Money

Start with maxing out free money. If you have a 401(k) with an employer match, contribute at least enough to get 100% of the match — it’s FREE money.

➡️ See how much your 401(k) could grow with my 401(k) Growth Calculator.

5. Automate Your Savings & Investing

Set up automatic transfers or set a schedule to pay your future self first — every paycheck, no excuses.

Review & Adjust

6. Check In Every 6 Months

Review your spending, contributions, and investments twice a year. Life changes — your plan should too.

🔗 Next Step

7. Run your numbers → Make your plan → Stick with it.

Recommended Budget App

Monarch Money is a budget app that will simplify managing your money in one place. Monarch will link all your accounts so you know where your money is and where it’s going with the ability to track and set budgets.

You can also grab my Personal Finance Dashboard (or upgrade to MMV Pro to get it for free):

Personal Finance Dashboard

Spend less time inputting data and more time reviewing where your money is going.

The FIRE movement offers a compelling path towards financial independence and early retirement by focusing on high savings rates, expense reduction, and strategic investing. While it requires discipline and commitment, the potential benefits of freedom, flexibility, and reduced stress can be significant. By understanding the principles of FIRE and implementing a well-thought-out plan, individuals can take control of their financial future and pursue a life of purpose and fulfillment.

I hope this guide simplified the concept of FIRE 🔥. Use the checklist to start your FIRE plan today!

Let’s stay connected!

📱 Follow me on Instagram: [millennialmoneyveteran]